Introduction of Financial Consultant

A business financial consultant plays a vital role in guiding enterprises through the complexities of financial management. These professionals are equipped with expertise in areas such as budgeting, forecasting, investment strategies, and risk management. By assessing a company’s current financial health and helping to develop tailored strategies, consultants enable businesses to make informed decisions that drive growth and profitability. Their insights can uncover inefficiencies, streamline processes, and ultimately lead to improved financial performance. In an increasingly competitive market, the collaboration with a qualified financial consultant can be the difference between stagnation and success.

Who is a Financial Consultant

A financial consultant is a seasoned expert who provides guidance on various aspects of a business’s financial management. These professionals possess a deep understanding of financial principles and practices, allowing them to assess a company’s financial situation comprehensively. They might work with businesses of all sizes, from startups looking to establish a solid financial foundation to established enterprises seeking to optimise their financial strategies. Financial consultants often specialise in specific areas, such as tax planning, investment analysis, or cash flow management, which enables them to offer tailored advice that meets the unique needs of each client. Their role extends beyond mere advice; they often become integral partners in a business’s success, helping to navigate complex financial challenges and ensure long-term sustainability.

Roles of a Financial Consultant

The roles of a financial consultant are multifaceted and critical to the overall health of a business. Primarily, they act as financial advisors, guiding companies in making strategic decisions that affect cash flow, investments, and budgeting. They conduct thorough financial analyses, monitoring key performance indicators (KPIs) to identify trends and potential areas for improvement. Additionally, financial consultants help in developing comprehensive financial plans that align with the company’s goals, ensuring that resources are allocated efficiently.

Beyond just planning, financial consultants also play a crucial role in risk management. By identifying potential financial risks and recommending strategies to mitigate them, they help safeguard the company’s assets and profitability. Furthermore, consultants assist with forecasting and scenario planning, enabling businesses to prepare for various economic conditions and make proactive decisions. Their collaborative approach fosters a partnership that empowers business owners, equipping them with the knowledge and confidence to navigate the financial landscape effectively.

The Importance of Financial Consulting for Business Growth and Stability

The value of financial consulting for businesses cannot be overstated. By tapping into the expertise of experienced professionals, business owners can gain a competitive advantage and unlock growth opportunities that would otherwise remain untapped. Here are some key benefits of working with a financial consultant:

Objective Perspective

One of the primary advantages of engaging a financial consultant is the objective perspective they bring to the table. Business owners, often deeply invested in their operations, may overlook certain financial aspects or fall into the trap of biased decision-making. A financial consultant, however, provides an unbiased analysis of the company’s financial health and performance. This impartial viewpoint is essential for identifying challenges and recognizing opportunities that may not be readily apparent to those within the organization. By relying on data-driven insights and industry benchmarks, financial consultants help companies make sound decisions rooted in factual analysis rather than subjective opinion. This objectivity is a cornerstone for developing a sustainable financial strategy that supports long-term growth and stability.

Expertise and experience

Financial consultants are specialists in their field, equipped with the knowledge and experience needed to navigate complex financial landscapes. By working with a consultant, businesses gain access to a wealth of knowledge that would be challenging to acquire otherwise. This expertise can prove invaluable when it comes to making critical financial decisions such as investment strategies or managing cash flow. Furthermore, financial consultants often have extensive industry-specific experience, enabling them to provide tailored advice that addresses specific challenges and opportunities within a particular sector.

Cost savings

While some business owners may view hiring a financial consultant as an additional expense, in reality, it can result in significant cost savings in the long run. A well-versed financial consultant can identify inefficiencies and areas for improvement within a company’s financial operations, resulting in cost reductions and increased profitability. Additionally, their expertise in tax planning and mitigation of financial risks can help businesses save money by avoiding unnecessary penalties or losses. Ultimately, the cost of hiring a consultant is often outweighed by the potential financial gains they bring to an organization.

Customised strategies

Every business is unique, with its own goals, challenges, and opportunities. Off-the-shelf solutions may not always be effective in addressing a particular company’s needs. Financial consultants offer customised strategies tailored to each client’s specific situation, ensuring that every decision is aligned with the organization’s objectives. This personalised approach results in more effective financial management and better outcomes for the business.

Range of Services Offered by Financial Consultants

The services offered by financial consultants can vary depending on their area of specialisation and the needs of their clients. Here are some common areas in which financial consultants provide guidance and assistance:

Financial planning and analysis

Financial planning is a critical aspect of any business, ensuring that resources are allocated efficiently to achieve company goals. Financial consultants help companies develop long-term financial plans, conduct performance analyses, and monitor key metrics to identify areas for improvement. They also assist with budgeting and forecasting, providing insights into potential risks and opportunities in the financial landscape.

Risk management

Financial consultants play a vital role in risk management by identifying potential financial risks and recommending strategies to mitigate them. Through thorough analyses of a company’s financial operations, consultants can identify areas that may be vulnerable to fraud, waste or inefficiency. They then work with businesses to implement controls and procedures that safeguard against these risks, protecting the company’s assets and profitability.

Tax planning

Tax planning is an essential component of sound financial management. Financial consultants assist companies in developing tax strategies that minimise their tax liabilities while remaining compliant with relevant laws and regulations. By leveraging their expertise in tax planning, consultants can help businesses save money and avoid potential legal issues that may arise from non-compliance.

Investment advice

Making sound investment decisions is crucial for a company’s long-term success. Financial consultants offer investment advisory services, using their expertise to help clients identify suitable investment opportunities that align with their financial goals and risk tolerance. They also monitor investments and provide ongoing recommendations to ensure optimal returns.

Additional Services:

- Budgeting

- Cash flow management

- Tax planning

- Retirement planning

- Insurance analysis

- Debt management

- Mergers and acquisitions

Real-Life Case Studies

Local Retail Business Turnaround

Challenge: The business faced financial struggles, including poor inventory management and pricing issues.

Solution: The financial consultant provided strategic advice on inventory management and pricing strategies.

Outcome: Within the first year, the business saw a 30% increase in profits.

Testimonial: “The consultant’s insights were a game changer for us,” says the business owner.

Tech Startup Funding Success

Challenge: The startup needed to secure funding to scale their operations.

Solution: The consultant refined the business plan and financial projections.

Outcome: The startup successfully secured funding.

Testimonial: “We couldn’t have done it without our consultant’s expertise,” says the startup founder.

Established Manufacturing Company’s Economic Navigation

Challenge: The company faced economic challenges affecting their industry.

Solution: The consultant implemented cost-saving measures and streamlined financial operations.

Outcome: Improved cash flow and resilience during tough economic times.

Testimonial: “Our consultant’s guidance helped us weather the storm,” says the company’s leadership.

Family-Owned Restaurant’s Growth

Challenge: The restaurant needed better budgeting and forecasting practices.

Solution: The consultant introduced efficient budgeting and forecasting practices.

Outcome: Significant growth in customer base and revenue, enabling expansion of offerings and marketing strategies.

Testimonial: “We achieved growth we never thought possible,” says the restaurant owner.

Tips for Choosing the Right Financial Consultant

Choosing the right financial consultant is essential for ensuring a positive impact on your business’s financial health. Here are some tips to consider when selecting a consultant:

Assess Experience and Expertise

Look for a consultant with a proven track record in your industry. Their experience and understanding of specific financial challenges faced by your sector can greatly enhance the relevance of their advice. Additionally, consider their areas of expertise; whether it’s tax planning, risk management, or investment strategy, the right consultant should possess skills that align closely with your business needs.

Evaluate Communication Skills

The ability to communicate complex financial concepts in an easily understandable manner is crucial in a consultant. During initial meetings, assess how well they explain their strategies and whether they take the time to listen to your concerns and goals. Effective communication fosters a collaborative relationship, ensuring that you are both on the same page throughout the consulting process.

Seek References and Reviews

Before making a decision, ask for references from previous clients or seek online reviews. Feedback from past clients can provide valuable insights into the consultant’s effectiveness, professionalism, and the outcomes they achieved. Trustworthiness and reliability are key qualities in a financial partner, so ensure you gather enough information to make an informed choice.

Define Goals and Expectations

Prior to engaging a consultant, clearly outline your goals and what you expect to achieve. This helps both you and the consultant to have a clear vision of the objectives at hand. Establishing measurable outcomes will also facilitate tracking progress and ultimately aid in evaluating the consultant’s impact on your business.

By carefully considering these factors, business owners can select a financial consultant who is best suited to support their unique needs, ultimately leading to enhanced financial performance and growth.

The Future Trends of Financial Consulting and Technology

The financial consulting industry is rapidly evolving, as new technologies continue to shape and streamline processes. Here are some of the future trends that are likely to impact financial consultants:

Automation and Artificial Intelligence

Advancements in automation and artificial intelligence (AI) are transforming many industries, including finance. With AI-powered software, financial consultants can analyze data more quickly and efficiently, reducing the time spent on manual tasks. This allows them to focus on higher-value activities such as providing strategic advice.

Data Analytics

Data analytics tools enable consultants to gather insights from large amounts of data quickly. By leveraging data analytics, consultants can provide more accurate forecasting and decision-making support for their clients. This technology also enables them to identify trends and patterns that may not be apparent to the human eye, providing a competitive advantage.

Virtual Consulting

With remote work becoming more prevalent, virtual consulting is expected to become increasingly popular in the future. This allows consultants to provide their services to clients regardless of location, making it easier for businesses to access top financial expertise. Additionally, virtual consulting can lead to cost savings for both parties, as there is no need for physical office space or travel expenses.

Cybersecurity Measures

As cyber threats continue to increase in frequency and sophistication, it’s crucial for financial consultants to have robust cybersecurity measures in place. This includes secure data storage and communication methods, as well as ongoing training for staff on how to handle sensitive financial information.

As the financial consulting industry continues to evolve, it will be essential for consultants to stay up-to-date with emerging technologies and adapt their practices accordingly. By embracing these trends, they can provide even more valuable and efficient services to their clients in the future. So, businesses should carefully consider the technological capabilities of potential consultants when making a selection. Ultimately, choosing a consultant who is able to leverage technology effectively can greatly enhance the success of your business.

Conclusion

In a rapidly changing financial landscape, the role of a financial consultant is more vital than ever. Businesses seeking growth and stability must navigate a myriad of financial challenges, making the expertise of a consultant invaluable. By selecting a consultant based on their experience, communication skills, and the ability to leverage emerging technologies, companies can ensure they are well-equipped to achieve their financial objectives. As the industry evolves, embracing innovations and adopting proactive strategies will be essential to maintaining a competitive edge. Ultimately, the right financial consultant not only guides businesses through current challenges but also positions them for long-term success and resilience in the face of economic uncertainties.

]]>Introduction of Mezzanine Debt

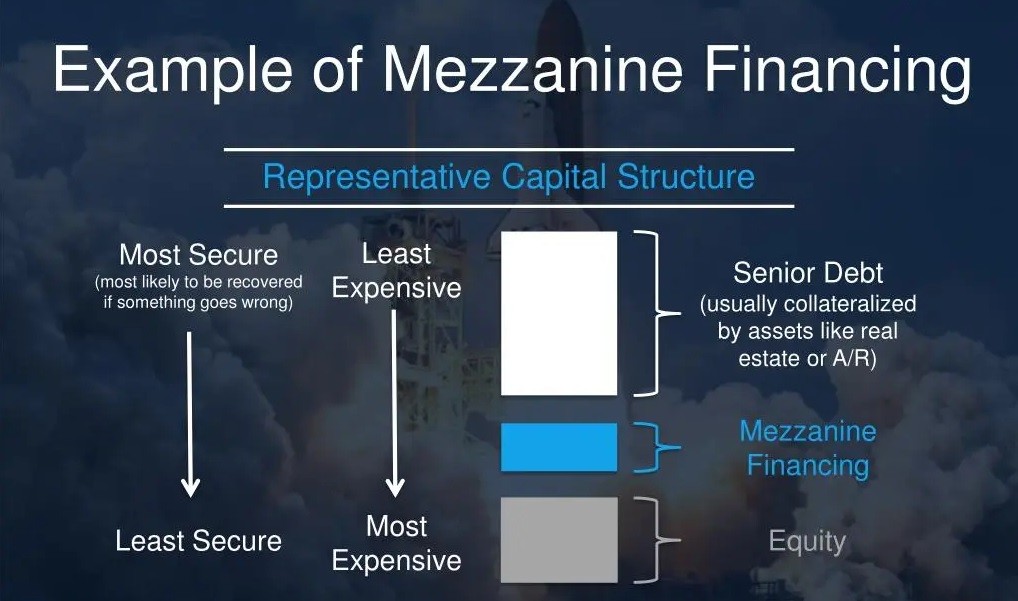

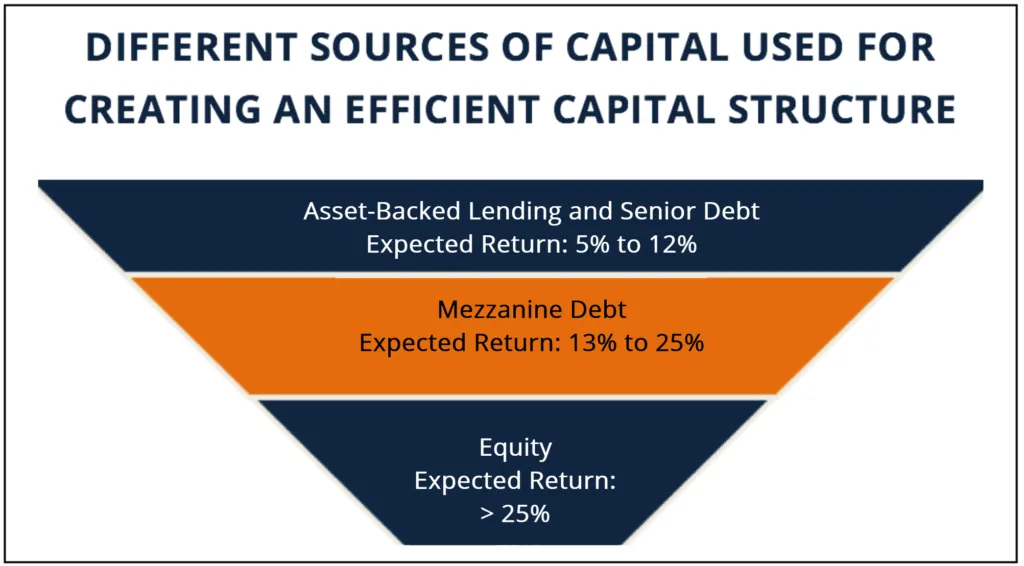

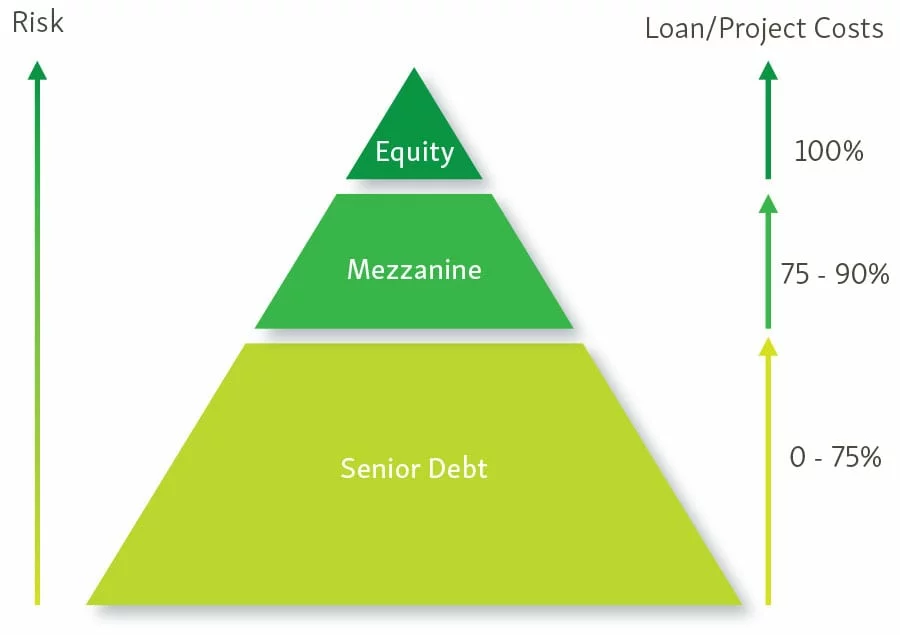

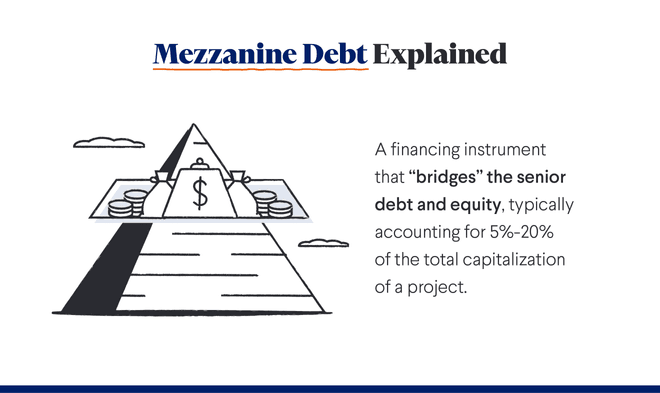

Mezzanine debt is a type of financing that sits in between traditional senior debt and equity on the capital structure. It typically takes the form of a loan with an attached equity component, such as warrants or convertible notes. The term “mezzanine” comes from the fact that it occupies a middle position on the balance sheet, ranking below senior debt but above equity.

What is Mezzanine Debt?

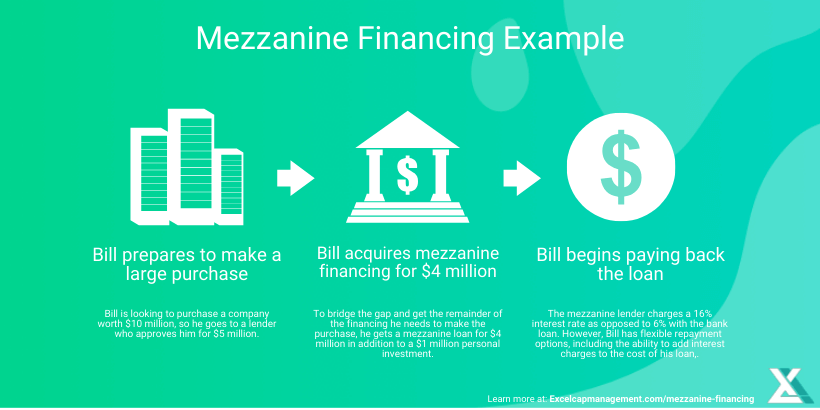

Mezzanine debt is a type of financing that combines elements of both debt and equity. It typically involves a loan that can be converted into equity if the borrower defaults. This hybrid nature allows mezzanine debt to offer higher returns for investors while providing borrowers with flexible financing options.

Comparison with Traditional Financing Methods

- Bank Loans: Typically secured and involve lower interest rates but come with strict repayment terms and collateral requirements.

- Equity Financing: Involves selling a stake in the company, which can dilute ownership and control but does not require repayment.

- Mezzanine Debt: Offers a higher return for investors than traditional bank loans, but does not require dilution of ownership and offers more flexibility in repayment terms.

Mezzanine debt sits between these two, offering the middle ground—higher interest rates than bank loans but no immediate dilution of ownership like equity financing.

The Advantages of Mezzanine Debt for Small Businesses

Small businesses can benefit from mezzanine debt in several ways:

Flexibility in Repayment Terms

One of the primary advantages of mezzanine debt for small businesses is the flexibility in repayment terms. Unlike traditional bank loans, which typically require fixed monthly payments over a set period, mezzanine financing often allows for interest-only payments during the initial years. This structure can provide small business owners with the breathing room they need during the growth phase, enabling them to reinvest cash flow into operations rather than directing it towards debt repayment. Additionally, the repayment schedule can be designed to align with the anticipated revenue growth, allowing businesses to pay down the debt as they achieve financial milestones. This flexibility can significantly enhance a company’s ability to scale while mitigating financial strain during critical development periods.

No Dilution of Ownership

Small business owners often hesitate to give up equity in their company, as it means surrendering a portion of control and potential future profits. Mezzanine debt offers an alternative solution by providing financing without diluting ownership. This allows small business owners to maintain full control over their company while still accessing the necessary capital for growth.

Access to Higher Amounts of Capital

As mezzanine debt is typically unsecured, lenders are willing to take on a higher risk than traditional bank loans, resulting in access to larger amounts of capital. For small businesses looking to finance significant expansion or acquisition opportunities, mezzanine debt can provide the necessary financial resources that may not be available through other financing methods.

Potential Tax Benefits

Mezzanine debt may also offer potential tax benefits for small businesses. The interest paid on mezzanine debt is typically tax-deductible, reducing the overall cost of borrowing and improving cash flow for the business.

Disadvantages of Mezzanine Debt

While mezzanine debt offers many advantages for small businesses, it’s important to consider the potential downsides as well:

Higher Interest Rates

As mezzanine lenders take on a higher risk than traditional bank loans, they often charge higher interest rates. This can significantly increase the cost of capital for small businesses and impact their overall profitability. It’s essential to carefully weigh the expected returns from the planned growth against the cost of borrowing before opting for mezzanine financing.

Potential Loss of Control

While mezzanine debt does not involve equity, it may come with certain covenants and conditions that can impact a business owner’s decision-making power. For example, lenders may require a seat on the board of directors or impose restrictions on future financing or dividend payments. It’s crucial to carefully review all terms and negotiate where possible to maintain control over critical business decisions.

How Small Businesses Can Successfully Leverage Mezzanine Debt

Before considering mezzanine debt as a financing option, small businesses should ensure they have a solid understanding of their financials, growth plans, and potential risks. Here are a few tips for effectively leveraging mezzanine debt:

Carefully Review and Negotiate All Terms

It is essential for small business owners to thoroughly review the terms and conditions of mezzanine debt before signing any agreements. Understanding interest rates, repayment schedules, and any covenants or restrictions is crucial to maintaining financial health. Business owners should also negotiate terms wherever possible, aiming to reduce interest rates or extend repayment periods to better suit their cash flow needs. Working with a financial advisor or legal expert can provide valuable insights during this process, ensuring all aspects of the agreement are clear and beneficial to the company’s long-term goals.

Develop a Clear Growth Strategy

Before seeking mezzanine financing, small businesses must have a clear plan outlining how the capital will be used to drive growth. This strategy should include detailed projections on revenue, anticipated expenses, and timelines for achieving specific milestones. A well-defined growth plan not only increases the likelihood of obtaining financing but also helps ensure that the business can effectively manage the obligations that come with mezzanine debt.

Maintain Transparency with Lenders

Building a solid relationship with lenders is vital for small businesses utilizing mezzanine debt. Maintaining open lines of communication and being transparent about business performance can foster trust and enable a more supportive partnership. Regular updates on progress towards growth objectives and any challenges encountered can help lenders understand the business’s circumstances and provide assistance when needed. In times of financial stress, strong communication can lead to renegotiation of terms or additional support that would not be available without such a relationship.

Monitor Financial Health

After securing mezzanine debt, small businesses should continuously monitor their financial health. This includes tracking cash flow, profitability, and key performance indicators (KPIs) to ensure that the business is on track to meet its growth targets. Regular financial assessments can provide early warnings of potential issues, allowing business owners to take proactive measures before they escalate into serious problems. This vigilant approach not only aids in managing debt responsibilities but also positions the business for future financing opportunities as it continues to grow.

By following these steps, small businesses can effectively leverage mezzanine debt to fuel expansion and navigate the complexities of financing with confidence.

The Application and Approval Process

The application and approval process for mezzanine debt can vary depending on the lender and the specific terms of the agreement. In most cases, it involves a thorough review of the business’s financials, growth plans, and potential risks to determine if it is a suitable candidate for financing.

What Lenders Look For

Lenders typically evaluate several factors, including:

- Strong Cash Flow: Demonstrating the ability to meet debt obligations.

- Solid Business Plan: Outlining growth strategies and financial projections.

- Experienced Management Team: Showing a track record of successful business operations.

- Collateral: While mezzanine debt does not require collateral, lenders may still consider the business’s assets to assess its overall financial health and ability to repay the loan.

Steps to Apply

- Prepare Financial Statements: Ensure your financials are up-to-date and accurately reflect your business health.

- Develop a Compelling Business Plan: Highlight your growth strategy and how mezzanine debt will support it.

- Submit Application: Provide all required documents and be ready for follow-up questions.

- Negotiate Terms: Work with a financial advisor or legal expert to review and negotiate terms that best suit your business’s needs.

- Final Approval: Once all terms are agreed upon, the lender will conduct a final review before approving the loan.

Approval Timelines and Conditions

Approval timelines can vary but generally range from a few weeks to a couple of months. Conditions may include covenants that require maintaining certain financial ratios. Failure to meet these conditions could result in penalties or default on the loan. To avoid such consequences, it’s crucial for small businesses to continually monitor their financial health and make necessary adjustments to stay compliant with lender requirements.

Successful Mezzanine Debt Stories

Many small businesses have effectively used mezzanine debt to finance their growth and navigate transitional phases. For instance, a tech startup seeking to expand its product line turned to mezzanine financing to bolster its research and development capabilities. By acquiring the necessary capital, the startup could innovate and introduce new offerings, significantly increasing its market share in a competitive landscape.

Boutique Tech Firm

Another notable example involves a boutique tech firm that specialised in creative digital solutions. Facing an opportunity to scale its operations significantly, the company sought mezzanine financing to support an ambitious marketing campaign and enhance its technology infrastructure. By securing the necessary funds, the firm not only increased its workforce but also improved service delivery, leading to a substantial increase in client acquisition and retention. This strategic use of mezzanine debt allowed the firm to solidify its position in the market while effectively managing the associated financial responsibilities. Such success stories underline the potential of mezzanine financing for small businesses looking to thrive in competitive industries.

Lessons Learned from Successful Cases

Examining the journeys of successful businesses that have utilised mezzanine debt reveals critical insights that can benefit other entrepreneurs. First and foremost, having a clearly defined vision and execution strategy is paramount. Companies that communicated their growth plans effectively to lenders were often met with more favourable terms and quicker approval processes. This emphasis on clarity not only builds lender confidence but also sets a roadmap that the businesses can adhere to during their growth phases.

Additionally, effective risk management plays a significant role in leveraging mezzanine financing successfully. Businesses that implemented strong financial controls and regularly reviewed their operational risks demonstrated higher resilience, allowing them to navigate challenges without jeopardising their debt obligations. This proactive approach not only mitigates risks but also enhances investor trust and aids in the long-term sustainability of the business.

Ultimately, the key takeaway for any small business considering mezzanine debt is that preparation, transparency, and prudent financial management are essential components that contribute to successful outcomes and sustained growth. By learning from existing examples and applying these lessons, new ventures can strategically position themselves to reap the benefits of mezzanine financing while effectively managing the associated challenges.

Finding the Right Lender and Navigating the Negotiation Process

Choosing the right lender for mezzanine financing is crucial and can significantly impact the success of a small business. When evaluating potential lenders, businesses should consider factors such as:

Identifying Reputable Lenders

Identifying reputable lenders is the first step in securing mezzanine financing. Entrepreneurs should start by conducting thorough research to find lenders who have a proven track record in providing mezzanine debt specifically. This can include looking for reviews, testimonials, and case studies of other businesses that have successfully worked with these lenders. Additionally, networking with industry peers, financial advisors, or attending industry conferences can provide valuable recommendations and insights into potential lenders.

Assessing Lender Fit

Once potential lenders have been identified, entrepreneurs should assess the fit by considering key aspects such as the lender’s experience in the specific industry, their overall lending philosophy, and the terms they offer. Each lender may have different criteria for evaluating applications, including their preferred risk profile, funding amount capabilities, and the timeline for approval. It’s essential to align a lender’s criteria with your business’s needs and goals to ensure a smooth negotiation process.

Initial Discussions

When initiating discussions with lenders, it’s prudent to be prepared with a comprehensive presentation of your business status, growth plans, and how mezzanine debt will contribute to achieving those goals. Clear communication of your vision and financial health helps establish credibility and fosters trust between you and the lender.

Negotiating Terms

Effective negotiation is vital when securing mezzanine financing. Entrepreneurs should be ready to negotiate terms such as interest rates, repayment schedules, and any associated covenants. Bringing in a financial advisor or legal expert during this phase can help you understand the implications of various terms and advocate for conditions that align with your business strategy. It’s essential to strike a balance between securing necessary funding and maintaining flexibility for the company’s growth trajectory.

By following these steps, small businesses can increase their chances of finding the right lender and establishing a favorable partnership, setting the foundation for successful mezzanine financing that supports their growth ambitions.

Conclusion

In conclusion, mezzanine financing can serve as a powerful tool for small businesses seeking to expand and innovate in competitive markets. By understanding the intricacies of this financing option and learning from the experiences of successful companies, entrepreneurs can better navigate the challenges that come with securing and managing mezzanine debt. The key lies in thorough preparation, maintaining open lines of communication with potential lenders, and developing a robust financial strategy that anticipates risks while fostering growth.

As small businesses continue to evolve and adapt in today’s dynamic landscape, leveraging mezzanine financing strategically will not only propel their ambitions but also create a pathway for sustainable success. Embracing these lessons can help ensure that businesses not only survive but thrive, paving the way for future generations of entrepreneurs.

]]>Introduction to Qfin

In today’s fast-paced and complex financial landscape, investors are constantly seeking ways to make informed decisions and achieve their financial goals. However, traditional investment methods often fall short in meeting the diverse needs of modern-day investors. This is where the Qfin Platform comes in – revolutionizing the way investments are made by providing a powerful solution that combines technology and finance.

Features of the Qfin Platform

The Qfin Platform offers a range of features that make it a game-changer in the world of finance. These include:

- Personalized Investment Strategies: The platform uses advanced algorithms and data analytics to create personalized investment strategies tailored to an individual’s risk tolerance, financial goals, and time horizon.

- Portfolio Optimization: Qfin’s portfolio optimization tool helps investors achieve maximum returns by creating a well-diversified portfolio that balances risk and return.

- Real-time Market Insights: With access to real-time market insights and trends, investors can make informed decisions and stay ahead of any potential market changes.

- Risk Management Tools: The platform also provides various risk management tools to help investors mitigate their exposure to market volatility and manage risk effectively.

- Integration with Investment Accounts: The Qfin Platform seamlessly integrates with existing investment accounts, making it easy for investors to access all their investments in one place.

Who Can Benefit from the Qfin Platform?

The Qfin Platform caters to a wide range of investors, including:

- Individual Investors: The platform offers personalized investment strategies for individual investors looking to grow their wealth and achieve financial stability.

- Wealth Managers: Wealth managers can leverage the platform’s advanced features to offer customized investment solutions to their clients and improve overall portfolio management.

- Institutional Clients: Institutions such as banks, hedge funds, and pension funds can benefit from the platform’s cutting-edge technology to optimize their investment strategies and boost returns.

Benefits of Using the Qfin Platform

The benefits of using the Qfin Platform are numerous and impactful for all types of investors.

Enhanced Decision-Making

Enhanced decision-making is one of the most significant advantages of utilizing the Qfin Platform. By leveraging advanced data analytics, machine learning, and real-time insights, investors can gain a comprehensive understanding of market conditions and identify potential opportunities quickly. This wealth of information enables users to make informed choices, minimizing impulsive decisions driven by market noise. Additionally, the personalized investment strategies cater to individual needs, ensuring that each decision aligns with their financial objectives and risk appetite. Ultimately, this intelligent approach not only simplifies the investment process but also elevates the potential for increased profitability over time.

Streamlined User Experience

In addition to enhanced decision-making, the Qfin Platform prioritizes a streamlined user experience. The intuitive interface is designed to accommodate users of all skill levels, from novice investors to seasoned professionals. Navigation through the platform is seamless, allowing users to access various tools and resources with ease. The dashboard provides a comprehensive overview of an investor’s portfolio, making it simple to track performance and make adjustments as needed. Furthermore, the platform’s educational resources equip users with the knowledge required to navigate the complexities of investing, empowering them to take control of their financial future confidently. By placing user experience at the forefront, the Qfin Platform ensures that investing is not only effective but also accessible to everyone.

Embracing Technology for Improved Performance

The Qfin Platform’s integration of technology sets it apart from traditional investment methods. By leveraging advanced algorithms and machine learning, the platform can analyze vast amounts of data in real-time and provide personalized solutions tailored to an individual’s needs. This approach not only streamlines the investment process but also enhances performance by identifying opportunities that would otherwise be missed. With technology continuously evolving, the platform is consistently updated with the latest advancements, ensuring that investors have access to cutting-edge tools and strategies.

Qfin vs. Traditional Financial Tools

Compared to traditional financial tools, the Qfin Platform offers a range of advantages that make it a preferred choice for investors. Some key differences include:

Personalization

One of the most significant advantages of the Qfin Platform over traditional financial tools is its emphasis on personalization. While traditional investment tools often rely on generic strategies that do not account for individual circumstances, the Qfin Platform utilizes sophisticated algorithms to tailor investment recommendations specifically to each user’s unique risk profile, financial objectives, and investment horizon. This level of personalization ensures that investors receive strategies that are more aligned with their personal financial goals, ultimately leading to better financial outcomes.

Advanced Analytics

In addition to personalization, the Qfin Platform harnesses the power of advanced analytics to provide insights that traditional tools may overlook. By leveraging big data and machine learning, Qfin can identify patterns and trends within the market, enabling investors to make data-driven decisions. This technology not only enhances predictive accuracy but also allows users to continuously refine their investment strategies based on real-time information and changing market conditions.

User-Friendly Interface

Another distinguishing feature of the Qfin Platform is its user-friendly interface, designed to simplify the investment process for users of all experience levels. Unlike many traditional financial tools that can be cumbersome and difficult to navigate, Qfin’s intuitive design enables investors to access vital information quickly and seamlessly. This emphasis on user experience facilitates a more engaging and efficient investment journey, encouraging greater participation and investment success.

Qfin’s Impact on Financial Technology Innovation

The development of the Qfin Platform represents a significant milestone in the evolution of financial technology. By combining cutting-edge technology with traditional finance principles, Qfin has created a platform that offers personalized and data-driven investment solutions to users.

Case Study 1: Qfin’s Algorithmic Trading Platform

A group of institutional investors adopted Qfin’s algorithmic trading system, resulting in a 40% increase in trading efficiency. The automated platform reduced manual errors and significantly improved portfolio management, showcasing the potential of AI-driven trading solutions.

Example 1: Qfin’s Personal Finance Management Tool

An individual investor utilized Qfin’s personal finance management tool and saw a 20% increase in their investment portfolio over six months. The tool provided actionable insights and personalized recommendations that helped the investor save and invest more effectively.

Case Study 2: Qfin’s Risk Assessment Software

A financial institution integrated Qfin’s risk assessment software into their operations, leading to a 30% reduction in non-performing loans. The software’s precise risk predictions and management capabilities proved invaluable in maintaining financial stability.

Example 2: Qfin’s Real-time Analytics Dashboard

A hedge fund manager employed Qfin’s real-time analytics dashboard to make informed decisions, resulting in a 15% increase in annual returns compared to the previous year. The dashboard’s comprehensive data and insights enabled timely and effective decision-making.

Expert Quotes

“Qfin is at the forefront of redefining financial technology with a focus on empowering investors through innovative tools and services.” – [Qfin CEO]

“The Qfin platform represents a significant leap in how technology can democratize access to financial markets, enabling both institutional and individual investors to make more informed decisions.” – [Industry Expert]

“In the fast-evolving landscape of financial technology, Qfin stands out as a pioneer, driving not just change, but the creation of new opportunities for all types of investors.” – [Fintech Analyst]

The Future of Qfin and Financial Technology

The Qfin Platform’s success showcases the potential for technology to revolutionize traditional finance, making it more accessible, personalized, and efficient. Moving forward, Qfin aims to continue innovating and expanding its services to cater to a broader range of investors across various industries. The future of financial technology looks promising with groundbreaking platforms like Qfin leading the way towards a more transparent and inclusive investment landscape.

Predictions for Further Innovation

Qfin is poised to continue its trajectory of innovation in the financial technology sector. Here are some potential developments:

- Expansion of AI Capabilities: Integrating more advanced AI and machine learning techniques to offer even more precise and personalized financial solutions.

- Enhanced User Experience: Continuous improvement of the platform’s user interface to make it more intuitive and accessible for all types of investors.

- Global Reach: Expanding Qfin’s services to more markets, helping investors worldwide benefit from its innovative tools.

- Collaboration with Industry Leaders: Partnering with established financial institutions and industry experts to further enhance the platform’s capabilities and reach.

With these advancements and more, Qfin is on track to continue shaping the future of financial technology and empowering investors around the world. So, it can be said that Qfin’s impact on financial technology innovation has only just begun. The possibilities for leveraging technology in finance are endless, and Qfin is leading the way towards a more transparent, efficient, and inclusive investment landscape.

New Features on the Horizon

Potential new features could include:

- Advanced Predictive Analytics: Offering deeper insights into market trends and future performance.

- Collaborative Tools: Enabling investors to collaborate and share insights within the platform.

- Enhanced Security Measures: Implementing state-of-the-art security protocols to protect user data and transactions.

- Personalized Investment Plans: Creating custom investment plans based on individual needs and goals.

With these features and more, Qfin is continuously evolving to provide users with cutting-edge solutions for their financial needs. As technology continues to advance, the potential for innovation in financial services is limitless, and Qfin remains at the forefront of this transformation. So, it can be said that Qfin’s impact on financial technology innovation has only just begun.

Summary of Qfin’s Impact and Success

Qfin has emerged as a transformative force in the financial technology landscape, successfully merging innovative technology with traditional financial principles to create a more accessible and efficient investment environment. Through the development of its versatile platform, Qfin has achieved significant milestones, such as improving trading efficiency by 40% through its algorithmic trading system and assisting individual investors in growing their portfolios by 20% using personalized finance management tools. The implementation of advanced risk assessment software has innovated loan management, while real-time analytics dashboards have empowered users to make informed decisions, leading to impressive annual returns. Qfin’s strategic focus on user experience, combined with its commitment to continuous improvement and expansion, sets a precedent for the future of financial technology, promising greater inclusivity and accessibility for investors globally. As Qfin forges ahead, its impact on the industry is poised to grow, positioning it as a leader in redefining the investment landscape. So, it can be said that the success of Qfin’s innovative platform has instigated a new era in financial technology. With its continued growth and advancements, Qfin is set to revolutionize the way we invest and manage our finances, making it more transparent, efficient, and accessible for all. So, the impact of Qfin’s innovation will continue to shape the future of finance for years to come. Overall, Qfin’s dedication to using technology for good has proved its immense potential in transforming traditional finance into an inclusive and modernized system. As we move towards a more digital world, platforms like Qfin are leading the way towards a better and brighter future for investors worldwide.

Conclusion

In conclusion, Qfin’s innovative approach to financial technology not only enhances the investment experience for users but also sets a precedent for the future of the industry. By leveraging advanced algorithms, real-time data analytics, and personalized tools, Qfin empowers both institutional and individual investors to make informed decisions with confidence. The case studies and testimonials reflect a transformative impact on investment efficiency and success, illustrating the immense value that Qfin brings to the table. As the financial landscape continues to evolve, Qfin will remain committed to pushing the envelope, ensuring that its platform not only meets current market demands but anticipates future trends. The journey ahead is filled with promising opportunities for growth, collaboration, and innovation, solidifying Qfin’s role as a leader in the ever-changing world of financial technology.

]]>In this guide, we will discuss some essential debt management strategies that will help you take back control of your finances and set yourself up for long-term success.

Introduction to Smart Finance

Before diving into debt management strategies, let’s first understand the concept of smart finance. Smart finance is all about making informed decisions when it comes to your money. It involves creating a budget, understanding your income and expenses, and setting realistic financial goals.

The key to smart finance is balance – balancing your spending and savings, balancing your wants and needs, and balancing your short-term desires with long-term financial stability. When it comes to debt management, this balance is crucial in order to avoid getting overwhelmed with debt.

Understanding Debt

Debt can be defined as an amount of money borrowed by one party from another. In personal finance, debt usually refers to any money that you owe to creditors or institutions. This can include credit card debt, student loans, mortgages, car loans, etc.

While some types of debt can be beneficial in helping you achieve your financial goals (e.g. taking out a mortgage to buy a home), excessive or mismanaged debt can have serious consequences on your overall financial well-being.

The Dangers of Uncontrolled Debt

High levels of debt can lead to significant financial stress and impact various aspects of your life. It can make it difficult to qualify for loans or credit in the future, affect your credit score, and even hinder your ability to secure employment or housing.

In addition, carrying too much debt means spending a significant portion of your income on interest payments rather than investing in your future. This can delay or prevent you from achieving important financial milestones, such as saving for retirement or buying a home.

Defining Smart Finance and Its Importance to Financial Planners

In today’s fast-paced financial world, mastering smart finance is crucial for anyone looking to manage their money effectively. For financial planners, understanding and implementing smart finance principles can mean the difference between a client’s financial success and long-term struggle. Smart finance encompasses a variety of strategies aimed at optimizing one’s financial health, with debt management being a fundamental component.

Brief Overview of Debt Management

Debt management is the process of strategically handling debt to improve overall financial stability. This involves creating a plan to pay off debts in an organized manner, often prioritizing based on interest rates and payment terms. Effective debt management can help individuals and businesses reduce financial stress, save money on interest, and build a stronger financial future.

Essential Debt Management Strategies

Now that we have a better understanding of debt and its potential consequences, let’s discuss some essential debt management strategies:

1. Create a Budget

The first step in managing your debt is to create a comprehensive budget. A well-structured budget will help you meticulously track your income and expenses, allowing you to identify areas where you may be overspending or could cut back. By categorizing your expenses—such as housing, food, transportation, and entertainment—you’ll gain a clearer understanding of your financial habits. It will also provide a transparent picture of how much money you have available each month to allocate towards paying off your debts, enabling you to set realistic financial goals.

2. Prioritize Your Debts

Not all debts are created equal, and understanding the differences is crucial for effective debt management. Some debts may carry higher interest rates, such as credit cards, while others, like student loans or mortgages, might have lower rates but more severe consequences for missing payments. By assessing the total amount owed, the interest rates, and the payment terms, you can prioritize your debts accordingly. Focusing on paying off the most urgent ones first, especially those with the highest interest, will help you reduce overall costs and alleviate financial pressure more quickly.

3. Negotiate with Creditors

If you’re struggling to make payments, don’t hesitate to reach out to your creditors. Open communication can be incredibly beneficial. Many creditors are willing to discuss potential options for repayment, including temporarily reducing your interest rates or offering alternative payment plans that better fit your financial situation. Some may even be open to negotiating a settlement for a lower amount if you can pay a lump sum. Remember, the key is to be proactive and honest about your situation—creditors appreciate when borrowers take responsibility for their financial health.

4. Consider Debt Consolidation

Debt consolidation can be a smart strategy, as it involves combining multiple debts into a single loan with a lower interest rate. This approach simplifies your financial obligations since you’ll only need to keep track of one loan instead of multiple payments. It can also potentially save you money in the long run, as lower interest means more of your payment goes toward reducing the principal. Before consolidating, it’s important to thoroughly research your options and weigh the pros and cons, ensuring that the terms of the new loan will genuinely benefit your overall financial health.

5. Avoid Taking on More Debt

While it may be tempting to continue borrowing, especially for emergencies or to maintain your lifestyle, it’s essential to avoid taking on more debt while trying to pay off existing ones. Adding more debt will only prolong the cycle and make it harder to achieve financial stability. Instead, focus on living within your means and exploring alternative solutions, such as cutting unnecessary expenses or finding additional sources of income. This discipline will not only help you pay down your debts faster, but it will also instill better financial habits that can lead to long-term stability and peace of mind.

Types of Debt: Good vs. Bad

Not all debts are created equal. Understanding the difference between good and bad debt is essential for smart finance:

Good Debt

Good debt refers to borrowed money that is likely to enhance your financial position over time. This type of debt typically includes investments that can generate income or appreciate in value, such as a mortgage on a home or student loans for education. For instance, a mortgage allows you to own a property that can increase in value and potentially provide rental income, while student loans may lead to higher earning potential in your career. When managed wisely, good debt can serve as a stepping stone towards long-term financial success, enabling you to invest in opportunities that contribute to your wealth.

Bad Debt

Conversely, bad debt is borrowing that doesn’t contribute to your overall financial health and may even detract from it. This includes high-interest consumer debt, such as credit card balances incurred from unnecessary purchases or payday loans with exorbitant fees. Bad debt can quickly spiral out of control, leading to financial strain and limiting your ability to save or invest. Recognising the difference between good and bad debt is crucial when managing your finances. Striving to minimise or eliminate bad debt while utilising good debt wisely can set you on a strong path towards achieving your financial goals.

Calculating Your Debt-to-Income Ratio

Your debt-to-income (DTI) ratio is a critical measure of your financial health. It compares your monthly debt payments to your monthly income. Here’s how to calculate it:

Add Up Your Monthly Debt Payments

Start by listing all your monthly debt obligations, which may include credit card payments, student loans, auto loans, mortgages, and any other debts requiring regular payments. Once you have a complete list, add these amounts together to find your total monthly debt payments. It’s important to ensure this figure accurately reflects your financial commitments, as it will be a key component in calculating your DTI ratio.

Calculate Your Monthly Income

Next, determine your total monthly income. This should include all sources of income, such as your salary, bonuses, and any side incomes from freelance work or investments. For a more accurate calculation, consider using your gross income (before taxes) rather than your net income, as lenders typically use gross income when assessing your financial health.

Divide Your Monthly Debt Payments by Your Monthly Income

With both figures in hand, calculate your debt-to-income ratio by dividing your total monthly debt payments by your total monthly income. For example, if your monthly debt payments amount to $2,000 and your monthly income is $5,000, your DTI ratio would be 0.4, or 40%.

Interpret Your DTI Ratio

A lower DTI ratio is generally viewed more favourably by lenders, as it indicates a healthier balance between debt and income. A DTI ratio of 36% or less is considered optimal, whereas ratios between 37% to 43% may still be acceptable but could signal that you’re nearing a riskier financial zone. Ratios above 43% often raise red flags and may hinder your ability to secure new loans or credit, making it essential to manage your debts effectively. Understanding your DTI ratio empowers you to make informed financial decisions and can guide you in setting goals for reducing debt and improving your overall financial stability.

Long-Term Financial Planning to Avoid Future Debt

While managing your existing debt is essential, it’s also crucial to plan for the long term and make proactive changes that can help you avoid future debt. Here are some steps you can take:

Create a Budget

A budget is a powerful tool for controlling your spending and staying on top of your finances. It allows you to track your income and expenses, identify areas where you may be overspending, and make necessary adjustments. By sticking to a budget, you can ensure that you’re living within your means and saving money for emergencies or other financial goals.

Build an Emergency Fund

Emergencies happen when we least expect them, and they can often lead to unplanned expenses. Building an emergency fund can provide a financial safety net and help you avoid turning to credit cards or loans when unexpected costs arise. Aim to save at least three to six months’ worth of living expenses in your emergency fund.

Invest in Yourself

Investing in yourself, whether through education, personal development, or career advancement, can pay off in the long run. By improving your skills and knowledge, you may be able to command higher salaries or take on side hustles that generate additional income. This can not only boost your overall earning potential but also provide more stability and security for your finances.

Seek Professional Guidance

If you’re struggling with debt or want expert advice on managing your finances, consider seeking guidance from a financial advisor. These professionals can help you create a solid financial plan and provide tailored advice to improve your money management skills. They can also offer insight on how to invest wisely and make the most of your income.

Case Studies in Smart Finance and Debt Management

Understanding theoretical concepts about debt is crucial, but concrete examples often provide greater insights into effective management strategies. Here are a couple of case studies illustrating successful debt management:

Case Study 1: Sarah’s Journey to Financial Freedom

Sarah, a recent college graduate, was initially overwhelmed by student loan debt and credit card balances. She started by consolidating her loans to secure a lower interest rate, then focused on paying off high-interest credit card debt first. By setting a strict budget and increasing her income through part-time work, Sarah managed to pay off all her debts within five years. Today, she continues to save diligently and invest in real estate, securing her financial future.

Case Study 2: Alex’s Strategy for Managing Multiple Debts

Alex had accumulated several types of debt, including student loans, car payments, and credit card balances. Rather than focusing on one type of debt at a time, he opted for a “snowball” approach – starting by paying off the smallest debts first, then using the freed-up payments to tackle larger debts. This method helped Alex build momentum and stay motivated as he worked towards becoming debt-free.

Conclusion

Smart finance and effective debt management are essential for financial planners aiming to help clients achieve financial stability and growth. By understanding different types of debt, creating a budget, prioritizing high-interest debts, negotiating with creditors, and utilizing debt consolidation, one can effectively manage and eliminate debt.

Financial planners play a crucial role in guiding clients toward smart finance practices. Implement these strategies to help your clients manage their debt and build a secure financial future.

Continuous education and planning are key to staying ahead in the financial world. Encourage your clients to stay informed and proactive in their financial management. Sign up for our newsletter for more tips and insights on smart finance and debt management.

By mastering smart finance and essential debt management strategies, you’ll be better equipped to guide your clients toward financial success. Start implementing these practices today for a brighter, debt-free tomorrow.

]]>Introduction to Financial Advisor

A financial advisor is a professional who provides expert advice and guidance on various financial matters. They help individuals and organizations make informed decisions about their finances, investments, taxes, and retirement planning. With their knowledge and experience, they can create personalized strategies to help their clients achieve their financial goals.

Brief Overview of the Importance of Financial Advisors

Financial advisors are professionals who help you manage your finances, plan for the future, and make informed decisions to achieve your financial goals. When it comes to retirement planning, their expertise can be invaluable. From maximizing your savings to minimizing tax implications, a financial advisor can guide you through the intricate process of preparing for your golden years. They can also help you create a realistic budget, invest in the right assets, and ensure that your retirement income lasts throughout your lifetime.

Why You Need a Financial Advisor for Retirement Planning

- Expertise and Knowledge: A financial advisor has the expertise and knowledge to help you navigate through the complexities of retirement planning. They are well-versed in various investment options, tax laws, and insurance policies that can help secure your finances for retirement.

- Personalized Plan: A financial advisor will work with you to create a personalized plan based on your financial goals, risk tolerance, and current financial situation. This ensures that your retirement plan is tailored to your specific needs and preferences.

- Retirement Income Planning: One of the most important aspects of retirement planning is ensuring a steady stream of income to cover expenses. A financial advisor can help you strategize and manage your investments to create a reliable source of retirement income.

- Tax Efficiency: As you near retirement, tax planning becomes crucial in optimizing your income and assets. A financial advisor can help you make tax-efficient decisions, such as utilizing tax-deferred accounts or taking advantage of deductions and credits.

- Estate Planning: A financial advisor can also assist with estate planning, ensuring that your assets are distributed according to your wishes after you pass away. They can also help minimize estate taxes and ensure a smooth transfer of wealth to your heirs.

Welcome to Your Retirement Planning Guide

Retirement is the golden phase of life that many of us look forward to. It’s a time when you can finally relax, pursue your hobbies, travel, and enjoy the fruits of your labor. However, achieving a comfortable and secure retirement requires careful planning and informed decision-making. This is where a financial advisor comes in. In this guide, we will discuss the importance of a financial advisor in securing your golden years and provide valuable insights on retirement planning. From understanding your financial goals to creating a personalized retirement plan, this guide will help you navigate through the intricacies of retirement planning with confidence and peace of mind.

Understanding the Role of a Financial Advisor in Retirement Planning

A financial advisor plays a crucial role in helping you achieve your retirement goals. They not only provide expert advice and guidance but also act as a trusted partner who can help you make well-informed decisions that align with your financial objectives.

What Does a Financial Advisor Do?

A financial advisor provides comprehensive financial planning services that cover various aspects of your financial life. For retirement planning, they:

- Assess your current financial situation.

- Help you set realistic retirement goals.

- Develop a personalized retirement plan.

- Provide investment advice and portfolio management.

- Offer tax planning and estate planning services.

Setting Realistic Goals for Retirement

The first step towards effective retirement planning is setting realistic goals. A financial advisor can help you assess your current financial situation, future income needs, and expected expenses to create achievable retirement goals. This involves evaluating factors such as inflation, market trends, and potential risks.

Creating a Diversified Investment Portfolio

Investing wisely is essential for securing your finances for retirement. A financial advisor can help you create a diversified investment portfolio that balances risk and return. This may include a mix of stocks, bonds, real estate, and other assets tailored to your risk tolerance and retirement goals.

Monitoring Your Retirement Plan

A financial advisor also plays an active role in monitoring and adjusting your retirement plan as needed. They can help you stay on track with your goals by regularly reviewing your investments, making necessary adjustments, and keeping you informed about potential risks or opportunities.

Key Benefits of Working with a Financial Advisor for Retirement Planning

Retirement planning is a complex process that requires careful consideration and expert guidance. A financial advisor can be an invaluable partner in helping you secure your financial future, allowing you to enjoy your golden years without worrying about money. We hope this guide has

Expert Guidance

Working with a financial advisor provides access to professional expertise that can simplify the often overwhelming process of retirement planning. Advisors stay updated on market trends, investment products, and regulatory changes, allowing them to offer informed recommendations tailored to each individual’s financial landscape. This guidance includes not just day-to-day investment decisions, but also long-term strategies that include retirement account optimizations, such as using IRAs and 401(k)s effectively. A financial advisor will also keep you accountable, ensuring that you remain committed to your retirement savings goals and making adjustments based on any life changes that could impact your financial situation. By leveraging their expertise, you can navigate the complexities of financial planning with greater confidence and clarity.

Personalized Approach

No two individuals have the same financial situation or retirement goals. A financial advisor takes a personalized approach to retirement planning, taking into consideration your unique needs, preferences, and risk tolerance. They work closely with you to understand your current financial status and create a customized plan that aligns with your future retirement dreams.

Comprehensive Services

Retirement planning is not just about investments; it also includes tax planning, estate planning, insurance coverage, and more. A financial advisor offers comprehensive services that cover all these areas of your financial life, ensuring that every aspect is carefully strategized to secure your retirement income.

Peace of Mind

With a trusted partner by your side who understands the complexities of retirement planning, you can have peace of mind that your financial future is in good hands. A financial advisor not only helps you create a solid retirement plan but also provides ongoing support and guidance, allowing you to enjoy your golden years without worrying about money.

Preparing for Retirement: Start Early and Stay Informed

As the saying goes, “the early bird catches the worm,” the earlier you start planning for your retirement, the better. A financial advisor can help you make informed decisions at each stage of your life, from saving and investing in your younger years to managing your retirement income during your golden years. By staying informed and proactively working towards your goals with a financial advisor’s guidance, you can ensure a smooth transition into retirement and secure a comfortable future for yourself and your loved ones.

Assessing Your Financial Situation

The first step in retirement planning is understanding where you stand financially. A financial advisor will help you:

- Evaluate your assets and liabilities.

- Analyze your income sources and expenses.

- Determine your net worth.

This assessment will give you a clear picture of your current financial health and help determine an appropriate retirement savings target.

Setting Realistic Retirement Goals

Your retirement goals should be realistic and achievable. With the help of a financial advisor, you can:

- Identify your desired retirement lifestyle.

- Estimate the cost of living in retirement.

- Set savings targets to meet your goals.

By setting realistic goals, you can avoid overestimating or underestimating your retirement income needs and ensure a comfortable retirement.

Creating a Retirement Plan

A financial advisor will work with you to create a personalized retirement plan that takes into account your current financial situation, future goals, and risk tolerance. This may include:

- Choosing the right investment vehicles.

- Diversifying your portfolio.

- Monitoring and adjusting your plan as needed.

Having a well-defined retirement plan in place can give you confidence that you are on track towards achieving your desired lifestyle post-retirement.

Early Planning Tips for a Secure Retirement

- Start Saving Early: The earlier you start, the more time your money has to grow.

- Contribute to Retirement Accounts: Maximize contributions to your 401(k), IRA, or other retirement accounts.

- Invest Wisely: Diversify your investment portfolio to balance risk and reward.

- Stay Informed: Stay updated on market trends and economic changes that could impact your retirement plan.

- Work with a Financial Advisor: Seek professional guidance for personalized advice and ongoing support in meeting your retirement goals.

Navigating the Transition into Retirement

As retirement approaches, it’s essential to start making adjustments to your financial plan. This includes:

Making the Most of Your Savings

Optimizing your retirement savings is crucial. A financial advisor can help you:

- Rebalance your portfolio to reduce risk as you approach retirement.

- Plan for required minimum distributions (RMDs).

- Implement strategies for sustainable withdrawals.

By making the most of your savings, you can ensure a steady income stream during retirement.

Considering Healthcare Costs

Healthcare costs are a significant expense in retirement. A financial advisor can help you understand your options and plan for these expenses by:

- Estimating potential healthcare costs in retirement.

- Choosing the right Medicare coverage.

- Setting up a health savings account (HSA) if eligible.

Taking proactive steps towards managing healthcare costs can prevent them from derailing your retirement plans.

Managing Retirement Income

A financial advisor can help you manage and maximize your retirement income while also considering factors such as taxes, inflation, and unexpected expenses. This may include:

- Creating a budget for retirement living expenses.

- Choosing when to start receiving Social Security benefits.

- Developing a tax-efficient withdrawal strategy.

Managing your retirement income effectively can help ensure that you have enough money to last throughout your golden years.

Choosing the Right Financial Advisor

Retirement planning is a complex and important process, so it’s crucial to choose the right financial advisor to guide you. Consider the following factors when selecting a financial advisor.

Qualities to Look for in a Financial Advisor

When selecting a financial advisor, consider the following qualities:

- Credentials and Experience: Look for certified financial planners (CFPs) with experience in retirement planning.

- Communication Skills: Choose someone who explains complex concepts clearly.

- Trustworthiness: Ensure they have a fiduciary duty to act in your best interest.

- Client Reviews: Check testimonials and reviews from other clients.

Types of Financial Advisors

There are various types of financial advisors, including:

- Commission-Based: Earn a commission on products they sell.

- Fee-Based: Charge a fee for services provided.

- Fee-Only: Only receive compensation from client fees, not commissions.

- Robo-Advisors: Use algorithms to provide automated investment advice.

Consider which type of financial advisor aligns with your needs and preferences.

How to Find the Best Advisor for Your Retirement Planning

- Referrals: Ask friends, family, or colleagues for recommendations.

- Professional Organizations: Use resources like the CFP Board or NAPFA to find qualified advisors.

- Interviews: Meet with potential advisors to discuss your needs and gauge their expertise.

- Research: Look into their credentials, experience, and any potential red flags.

By taking the time to research and consider your options, you can find a financial advisor who you trust to guide you towards a secure retirement. Overall, proper retirement planning requires careful assessment of your financial situation, setting realistic goals, creating a personalized plan, and working with a trusted financial advisor. By following these steps and staying proactive in managing your finances during retirement, you can ensure a comfortable future for yourself and your loved ones. Keep in mind that this journey is an ongoing process and may require adjustments along the way.

Conclusion

In summary, effective retirement planning is paramount to achieving financial security and peace of mind in your later years. By understanding your current financial situation, setting realistic goals, and creating a comprehensive retirement plan with the help of a qualified financial advisor, you can pave the way for a stable and enjoyable retirement. Remember to continually monitor your progress and stay informed about any changes in economic conditions or personal circumstances that may affect your plan. With thoughtful preparation and proactive management, you can embrace your retirement years with confidence and clarity, focusing on the experiences and pursuits that bring you joy.

]]>In this guide, we will discuss the essential aspects of financial planning specifically tailored for professionals. Whether you are just starting out in your career or already established in your field, it is never too early or too late to secure your tomorrow.

Introduction to Financial Planner

Financial planning involves assessing your current financial situation, defining your goals, and creating a strategic roadmap to achieve them. It encompasses various elements such as budgeting, saving, investing, and insurance. For professionals, it’s particularly important to consider factors like fluctuating incomes, career advancement prospects, and potential changes in lifestyle. By systematically evaluating these aspects, you can develop a comprehensive plan that not only prepares you for future uncertainties but also enables you to make informed decisions in your everyday financial dealings. This proactive approach can help you navigate the complexities of modern finance, ensuring that you remain on track to meet your personal and professional ambitions.

What do Financial Planners Do

Financial planners play a crucial role in helping individuals and families manage their finances effectively. They offer comprehensive advice tailored to each client’s unique circumstances and goals. First and foremost, financial planners assess their clients’ financial situations, including income, expenses, assets, and liabilities. This allows them to identify areas for improvement and opportunities for growth.

Once the assessment is complete, planners help clients establish clear financial goals, whether it’s saving for retirement, purchasing a home, funding education, or building an investment portfolio. They then create actionable strategies, which might include budgeting techniques, investment recommendations, and insurance coverage options, to guide clients toward achieving these objectives. Additionally, financial planners provide ongoing support and periodic reviews to adapt the strategy as personal circumstances and market conditions change, ensuring that clients stay on track to secure their financial future.

Why Financial Planning is Important for Professionals

Financial planning involves creating a roadmap to achieve your short-term and long-term financial goals. It helps you make informed decisions about spending, saving, investing, and managing debt.

For professionals, financial planning is crucial because of the following reasons:

- Variable Income: As a professional, your income may not always be consistent. You may go through periods of high income and low income, making it essential to plan for both scenarios.

- Retirement: Unlike salaried employees who have employer-provided retirement plans, professionals are responsible for creating their own retirement savings. This requires careful planning and investing in the right vehicles.

- Tax Management: Professionals often have complex tax situations with multiple sources of income and deductions. A good financial plan can help you optimize your taxes and save money in the long run.

- Career Advancement: Financial planning also involves setting aside funds for professional development and career advancement opportunities. This can include further education, certifications, or starting your own business.

- Lifestyle Changes: As professionals progress in their careers and experience changes in income, they may also face lifestyle changes such as getting married, buying a house, or having children. A well-defined financial plan can help you adapt to these changes and secure your future.

Importance of Financial Planning for Working Professionals

Financial planning isn’t just about saving money; it’s about creating a roadmap for your financial future. Here’s why it’s crucial for working professionals:

Secure a Stable Future

Establishing a solid financial plan allows working professionals to build a foundation for a secure future. With a well-structured approach, you can allocate your resources effectively to ensure that both your present and future needs are met. This stability not only reduces financial stress but also grants you the freedom to pursue your passions and interests without the burden of financial uncertainty. By prioritising savings and investments, you create a safety net that can support you during unexpected challenges, such as job loss or medical emergencies. Moreover, a stable financial future enables you to set long-term goals, whether that’s buying a home, travelling the world, or securing a comfortable retirement, empowering you to live life on your own terms.

Achieving Financial Independence

Financial independence is a key aspiration for many professionals, and effective financial planning is the pathway to achieving this goal. By carefully managing your income and expenses, you can accumulate wealth over time, which in turn provides you with more choices and freedoms in life. This might mean earlier retirement, the ability to take career risks, or simply enjoying a more comfortable lifestyle. Furthermore, financial independence allows you to give back to your community, invest in causes you care about, or support family members in need. Emphasising the importance of saving and smart investing, financial planners can guide you on the best strategies to build your net worth and ultimately gain the independence you desire.

Adapting to Changing Circumstances